Fundamental Analysis And Technical Analysis: Key Features

Introduction

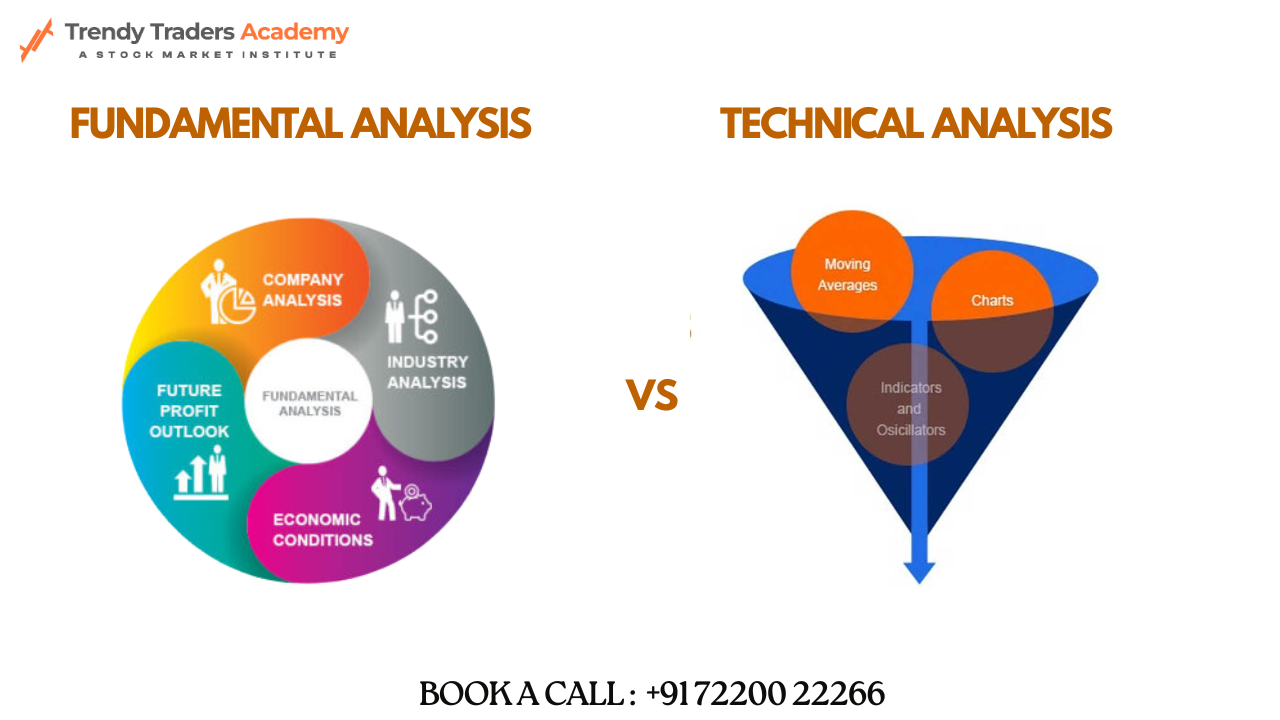

Are you wondering how traders predict market movements? Ever heard of Fundamental Analysis and Technical Analysis? These two methods are widely used to evaluate stocks and make investment decisions. While one focuses on company performance and financials, the other relies on price patterns and charts.

Understanding these techniques can significantly boost your trading skills. Whether you’re a beginner or an experienced investor, learning both approaches can give you a competitive edge. So, let’s dive deep and explore their key features!

Understand the key features of Fundamental and Technical Analysis. Learn how they impact stock trading. Enroll in trading courses , Best stock market course today!

What is Fundamental Analysis?

Fundamental Analysis is like checking the health of a company before investing. It looks at financial statements, earnings, revenue, industry position, and even economic conditions to determine whether a stock is worth buying.

Key Factors Considered in Fundamental Analysis:

- Financial Statements (Balance Sheet, Income Statement, Cash Flow)

- Company Performance & Growth Potential

- Industry & Market Conditions

- Macroeconomic Factors (Inflation, Interest Rates)

- Intrinsic Value Calculation

Fundamental analysts believe that a company’s real worth determines its stock price in the long run.

What is Technical Analysis ?

Unlike Fundamental Analysis, Technical Analysis is more like studying a stock’s heartbeat using past price movements and volume. Traders use charts, indicators, and trends to predict future stock prices.

Key Tools Used in Technical Analysis:

- Candlestick Charts

- Moving Averages

- Support and Resistance Levels

- Momentum Indicators (RSI, MACD)

- Chart Patterns (Head & Shoulders, Double Bottoms)

Technical analysts believe that price movements follow trends, and history often repeats itself.

Key Differences Between Fundamental Analysis and Technical Analysis

| Feature | Fundamental Analysis | Technical Analysis |

| Focus | Company’s financial health | Price movements & charts |

| Timeframe | Long-term investment | Short-term trading |

| Tools Used | Financial reports, economic indicators | Charts, patterns, indicators |

| Approach | Value-based investing | Trend-based trading |

Both methods serve different purposes. Some traders use a mix of both to enhance their strategies.

Key Features of Fundamental Analysis

- Focuses on intrinsic value – Determines if a stock is overvalued or undervalued.

- Long-term approach – Best for investors with a long-term perspective.

- Relies on financial reports – Requires understanding of financial statements.

- Affects stock valuation – Helps in making strong investment decisions.

Key Features of Technical Analysis

- Focuses on price trends and patterns – Uses historical data to predict future movements.

- Short-term trading method – Ideal for day traders and swing traders.

- Doesn’t consider company fundamentals – Purely based on market behavior.

- Uses technical indicators – RSI, MACD, and Bollinger Bands are widely used.

When to Use Fundamental Analysis ?

Use Fundamental Analysis when:

- Investing for the long term (5+ years)

- Evaluating a company’s growth potential

- Understanding overall market trends

When to Use Technical Analysis ?

Use Technical Analysis when:

- Day trading or swing trading

- Identifying entry and exit points

- Capitalizing on short-term price movements

Which is Better for Beginners ?

If you’re just starting, it’s best to learn both! Fundamental Analysis helps in choosing solid stocks, while Technical Analysis improves timing decisions.

How to Learn These Analysis Methods ?

You can master these methods by enrolling in trading courses, Best stock market course online. Many platforms offer structured lessons, live market practice, and expert mentorship.

Common Mistakes to Avoid

- Relying on one method only – A balanced approach is better.

- Ignoring market trends – External factors affect stock prices.

- Not managing risk – Always have a stop-loss strategy.

Final Thoughts

Both Fundamental Analysis and Technical Analysis play crucial roles in stock trading. While one tells you what to buy, the other tells you when to buy. Combining both can make you a well-rounded trader.

If you’re serious about trading, consider joining professional trading courses to deepen your knowledge and sharpen your skills.

FAQs

1. Can I use both Fundamental and Technical Analysis together ?

Yes! Many successful traders combine both methods for better decision-making.

2. Which analysis method is better for long-term investors ?

Fundamental Analysis is better suited for long-term investments.

3. How long does it take to learn these analysis methods ?

It depends on your dedication, but with a Best stock market course, you can learn in a few months.

4. Do technical indicators always work ?

Not always. No strategy is 100% foolproof. Market conditions change frequently.

5. Where can I learn stock trading analysis ?

You can join online trading courses that teach both Fundamental and Technical Analysis effectively.

Fundamental and Technical Analysis – Key Features Explained