SharkShop Credit Card Discounts: How to Use Them to Save Big

Are you ready to dive into a sea of savings? If you’re a savvy shopper looking to make the most of your purchases, then SharkShop.biz Credit Card discounts are about to become your new best friend! Whether you’re hunting for the latest fashion trends, tech gadgets, or home essentials, these exclusive deals can help you reel in substantial savings with every swipe.

In this blog post, we’ll explore how to maximize your SharkShop Credit Card benefits so that you can enjoy guilt-free shopping sprees while keeping more cash in your pocket. Get ready to unlock incredible discounts and discover tips and tricks that will transform the way you shop—let’s swim right into it!

Introduction to SharkShop Credit Card Discounts

Are you a savvy shopper looking to maximize your savings? If so, the SharkShop.biz credit card might just be your ticket to incredible discounts and exclusive offers. With its enticing perks, this store credit card has gained popularity among consumers eager to stretch their dollars further. But what exactly are these discounts, and how can you take full advantage of them?

Dive into the world of SharkShop credit card discounts with us as we explore everything from application processes to real-life success stories that illustrate just how much you could save! Whether you’re a seasoned SharkShop customer or new to the brand, there’s something here for everyone aiming for big savings on their next shopping spree.

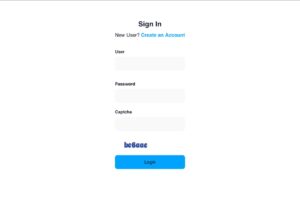

A Screenshot of Sharkshop (Sharkshop.biz) login page

How to Apply for a SharkShop Credit Card

Applying for a SharkShop Credit Card is a straightforward process. Start by visiting the SharkShop website or heading to your nearest store location.

You’ll need to provide some basic information, including your name, address, and Social Security number. Be prepared to share your income details as well. This helps determine your creditworthiness.

Once you’ve filled out the application form, submit it either online or in-store. You may receive an instant decision about approval or rejection.

If approved, you’ll get quick access to your account benefits. Keep an eye on the mail for your physical card; it usually arrives within a week or two.

Make sure you read through all terms and conditions carefully before using your new card. Understanding these details can help maximize its advantages from day one.

Benefits of Having a SharkShop Credit Card

Having a SharkShop Credit Card opens up a world of exciting benefits. First and foremost, cardholders enjoy exclusive discounts on in-store purchases. This means lower prices on the items you love most.

Additionally, many credit card holders receive rewards points for every dollar spent. These points can be redeemed for future discounts or special offers, making each shopping trip more rewarding.

Another perk is access to limited-time promotions. Being part of the SharkShop family keeps you updated on flash sales and member-only events that can lead to even greater savings.

Plus, using this credit card helps build your credit score when managed responsibly. This could enhance your financial opportunities down the line.

Lastly, customer service tailored specifically for SharkShop members ensures any issues are handled promptly and efficiently. It’s all about enhancing your shopping experience while saving money!

Understanding the Different Types of Discounts Offered

SharkShop login offers a variety of discounts tailored to different shopping needs. Understanding these can enhance your overall experience.

One popular option is the percentage-off discount, where cardholders enjoy specific savings on their total purchase. This can be especially beneficial during sales events or holiday promotions.

Then there are exclusive member-only deals. These often include flash sales that last for a limited time, giving you access to products at reduced prices before they’re available to regular shoppers.

Another enticing type is cashback rewards. With each purchase made using your SharkShop credit card, you earn a percentage back, which can add up quickly over time.

Lastly, seasonal bonuses provide additional incentives to shop during particular times of the year. These discounts might include double points days or special price cuts on seasonal items. Each type presents an opportunity for savvy shoppers to maximize their savings effectively.

Tips for Maximizing Your Savings with SharkShop Credit Card Discounts

To get the most out of your SharkShop credit card, timing is everything. Pay attention to seasonal sales and special promotional events. These times often coincide with additional discounts for cardholders.

Utilize your rewards points wisely. Many cards offer points that can be redeemed for future purchases or exclusive deals. Keep track of these offers to boost your savings even further.

Don’t forget about combining offers. Check if you can stack store promotions on top of credit card discounts for maximum benefits.

Setting reminders before payment due dates helps avoid late fees, which could undermine any savings you’ve earned through discounts.

Lastly, consider setting a budget specifically for shopping at SharkShop using this card, ensuring you’re only spending what you can afford while still reaping all those fantastic rewards!

Real Life Examples of How Customers Have Saved Big with SharkShop Credit Card Discounts

Maria, a frequent shopper at SharkShop, recently took advantage of the card’s seasonal promotion. She needed new winter gear for her family. By using her SharkShop credit card, she saved 20% off her entire purchase during the holiday sale.

Then there’s Jake, who always keeps an eye out for exclusive member events. He attended a special one-day sale and scored an additional 15% discount on already marked-down items. Those savings added up quickly!

Another customer, Lisa, combined cashback rewards with her card benefits while purchasing electronics. The final price was far lower than expected after applying both discounts.

These stories illustrate how savvy shoppers leverage their SharkShop credit cards to maximize savings on everyday purchases and big-ticket items alike. Each experience highlights different ways to capitalize on available offers effectively.

Potential Drawbacks and Risks of Using a Store Credit Card

Store credit cards can seem like a tempting offer, but they come with risks that shoppers should consider. One major drawback is the often high-interest rates associated with these cards. If you don’t pay off your balance in full each month, those interest charges can add up quickly.

Another concern is the impact on your credit score. Applying for multiple store credit cards can lead to hard inquiries on your report, which may lower your score temporarily. This could affect future borrowing opportunities.

Additionally, some consumers find themselves overspending just to take advantage of discounts or rewards associated with their card. It’s easy to get carried away when shopping, leading to potential financial strain later on.

Finally, limited acceptance is another issue; store credit cards are typically only valid at specific retailers. This restricts flexibility and might not be beneficial for everyone seeking broader purchasing options.

Alternatives to Using a Store Credit Card for Discounts

If store credit cards aren’t your style, there are plenty of other ways to save at SharkShop cc. Consider using loyalty programs. Many retailers offer points for every dollar spent, which can lead to significant savings on future purchases.

Another option is signing up for email newsletters. Brands often send exclusive discounts and promo codes directly to subscribers. This way, you can snag deals without the commitment of a credit card.

Mobile apps are also worth exploring. Downloading SharkShop’s app may provide instant notifications about flash sales or special offers available only through the app.

Cashback websites present another avenue for savings too. By shopping through these platforms, you can earn a percentage back on your purchases at SharkShop, adding extra value to each transaction.

Lastly, consider timing your shopping trips during major sale events like Black Friday or end-of-season clearance sales where markdowns tend to be steep across the board!

Conclusion: Is a SharkShop Credit Card Right for You?

When considering whether a SharkShop.biz credit card is right for you, it’s essential to weigh the benefits against potential drawbacks. The discounts offered can lead to significant savings if used wisely, especially for frequent shoppers. However, remember that managing credit cards requires discipline. Overspending or accumulating debt can negate any advantages earned through discounts.

Evaluate your shopping habits and financial situation before applying. If you often shop at SharkShop and are confident in your ability to pay off the balance each month, it could be a valuable addition to your wallet. On the other hand, if you’re prone to overspending or prefer more flexibility with payment options, exploring alternatives might serve you better.

Ultimately, understanding what fits best with your lifestyle will help you make an informed decision about the SharkShop credit card and its enticing discounts.