The property management industry in 2024 continues to be a significant sector within the broader real estate market. It plays a crucial role in managing residential, commercial, and industrial properties on behalf of property owners. The following are key statistics and trends related to the industry in 2024:

1. Market Size & Growth

- Global Market Size: The global property management market was valued at around $19.25 billion in 2023, with projections indicating it will continue growing at a CAGR (Compound Annual Growth Rate) of approximately 7.5% from 2024 to 2030. This growth is driven by the increasing demand for professional property management services as more investors, developers, and landlords outsource property operations.

- U.S. Market Size: In the United States, the property management industry is valued at around $100 billion as of 2023, with expectations to grow steadily in 2024, spurred by strong real estate markets and increasing numbers of rental properties.

2. Industry Segmentation

The property management industry is divided into several key sectors:

- Residential Property Management: Managing single-family homes, multifamily units, and apartment complexes. This remains the largest sector, driven by the increasing number of renters in urban and suburban areas. As of 2023, over 43 million Americans were renting their homes, a trend that is expected to persist into 2024.

- Commercial Property Management: Involves the management of office buildings, retail centers, and industrial properties. The commercial sector has been impacted by post-pandemic changes in work habits (remote work, hybrid models) but is gradually recovering, with more businesses seeking flexible leasing options.

- Vacation/Short-Term Rental Management: The growth of platforms like Airbnb and Vrbo has led to a surge in demand for vacation rental management services. This sector continues to grow, with estimates indicating there are over 1 million short-term rental properties worldwide, and the market for short-term rental management is projected to grow by about 10% annually.

3. Key Trends in Property Management (2024)

- Technology Integration: The adoption of technology in property management is accelerating. Property management software is increasingly used for everything from rent collection to maintenance tracking and communication with tenants. More than 80% of property managers use property management software in some capacity, and the global market for such software is expected to reach $4.8 billion by 2026.

- Sustainability & Green Buildings: Property owners and managers are increasingly focusing on sustainability initiatives, such as energy-efficient appliances, solar panels, and green building certifications. The push for eco-friendly properties is expected to continue, especially in urban markets, where environmental regulations are tightening.

- Automated Rent Collection & Payments: Nearly 70% of property managers are now offering automated rent collection through online portals and mobile apps, making it easier for tenants to pay rent and reducing administrative workload.

- Increase in Renter Demand: The increasing demand for rental properties, especially among younger generations, continues to drive the residential property management market. Millennials and Gen Z are renting for longer periods due to economic factors like student debt, rising home prices, and a desire for flexibility.

4. Property Management Companies

- Number of Property Managers: As of 2024, there are approximately 300,000 property management companies operating in the U.S., managing over 24 million rental units.

- Average Size of Property Management Firms: Around 50% of property management companies in the U.S. manage fewer than 250 units. However, large companies, like CBRE and Cushman & Wakefield, manage portfolios in the tens of millions of square feet of commercial space.

5. Financial Metrics

- Revenue Per Unit: On average, property management firms in the U.S. generate between $200 and $300 in monthly revenue per managed unit, depending on the property type, location, and services offered.

- Property Manager Salary: The average salary for a property manager in the U.S. in 2024 is approximately $60,000 per year, though this varies based on experience, location, and the type of property managed. Salaries in urban areas or those dealing with luxury properties can exceed $80,000 annually.

- Management Fees: For residential properties, property management companies typically charge between 8% and 12% of the monthly rent for management services. For commercial properties, the fees can range from 4% to 7%, depending on the lease structure and size of the property.

6. Challenges Facing the Industry

- Labor Shortages: The property management industry faces ongoing challenges related to staffing, particularly for maintenance and on-site management positions. The demand for skilled workers in trades like plumbing, electrical, and HVAC is growing, leading to higher labor costs.

- Rent Control & Regulatory Pressure: In some markets, rent control measures and increasing government regulations are creating challenges for property managers. There is a growing need for compliance with evolving local, state, and federal laws, especially around fair housing, eviction rules, and rent increases.

- Cost of Repairs & Maintenance: Property managers are contending with rising costs for building materials and labor, which can impact profitability, particularly for smaller property owners who may not have the same purchasing power as large firms.

7. Outlook for 2024

- Growth in Residential Rental Market: As the housing market remains tight and homeownership continues to be out of reach for many potential buyers, demand for rental properties is expected to remain strong. This is particularly true in urban areas where prices for single-family homes continue to rise.

- Focus on Tenant Experience: Property managers are increasingly focusing on providing a superior tenant experience to reduce turnover and increase tenant retention. This includes offering amenities, enhancing communication via apps or portals, and making the rental process smoother and more efficient.

8. Major Players in the Industry

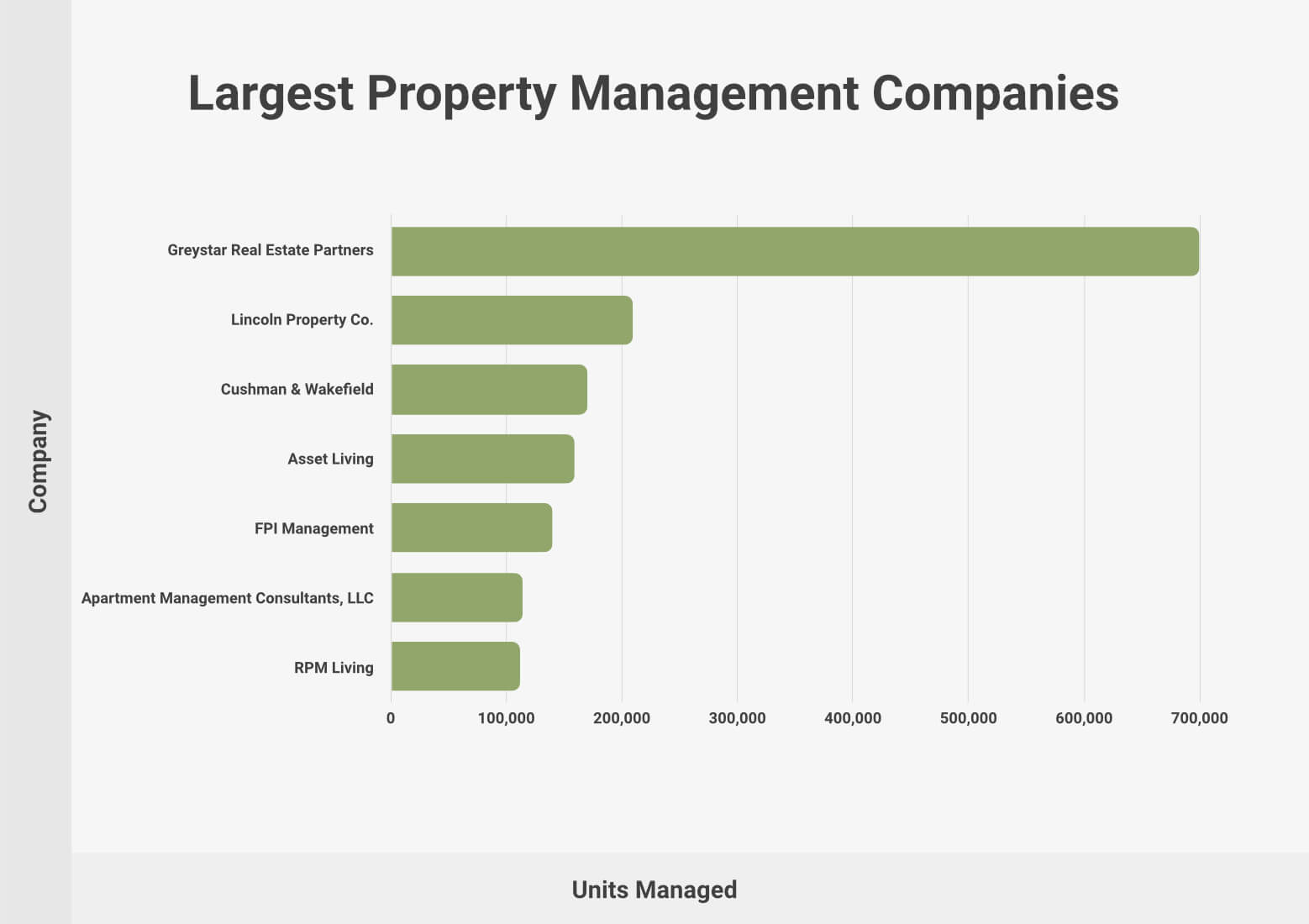

- Some of the largest property management firms in 2024 include:

- CBRE Group

- Cushman & Wakefield

- Jones Lang Lasalle (JLL)

- Colliers International

- Greystar Real Estate Partners (largest global residential property manager)

These firms manage large portfolios of both commercial and residential properties and are key players in shaping industry trends.

These statistics highlight the continued growth and evolution of the property management industry in 2024, shaped by technology, tenant demands, and changing economic conditions. As a result, property managers must adapt to these shifts while maintaining operational efficiency and compliance with an increasingly complex regulatory environment.